Payroll is a critical operation for every company to pay its employee their salary and enrolments on time accurately. Taking control of all of the employees pay calculations is very difficult if done by ourselves and it requires more effort and time for big companies. Hence, suppose if this process is automated, it would yield great benefits, as it would require less time to calculate the salary of the employees. The software for payroll management system service on the cloud is provided. This provides multiple user data access. Each user like employee or HR or admin can login into the software by writing the username and password which are allocated to the employees from their company. It also involves keeping the perfect track of hours worked by the employees and it is also capable of keeping a record of various employee data which includes their pay, allowances, deductions, and taxes on monthly bases, so that the fresh definitions are reflected from the month onwards, which leaves all the past data stay intact. This payroll system is advantageous as it provides a user-friendly environment and also increases security and helps minimize human calculation errors.

There are two types of payroll systems which are:

- Computer based payroll system:

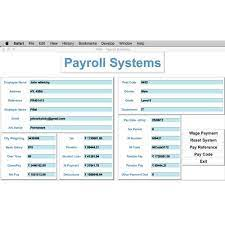

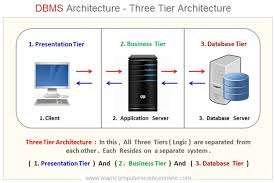

In a company, there are various departments, and each department has a specific payroll section to help manage its payroll activities. Each section has to perform few required operations such as collecting the data and preparation, entry, updates, monitoring and reporting the data. Many of these practices and procedures need to be cross checked at this time of changing needs, changing demands of employees and evolving technologies. With this particular payroll system, section of the payroll would be able to keep a record of employees including their personal data, pay slips, allowances, deductions, leave, savings, and taxes. Net pay of each employee is calculated by their allowances and deductions mentioned according to the rules of the company. The individual pay slips are printed out as a receipt if the particular employee wants to get a printout. Pay bands, allowances, deductions, and information related to the tax are updated if there is any amendment or change in salary structure. The computer-based payroll application is a web-based design. The server-side of this application is partitioned in terms of logic into three-tiers or layers.

Each layer performs a unique function and are as follows:

1) Presentation Layer: Presentation Layer is a user interface which every user is able to see on the computer, mobile and window screen. Designing part of any application is known as Presentation Layer. The User can post input and get output on the presentation layer only. In asp.net .aspx file is known as a presentation layer. In case of web applications, the web browser (Internet Explorer, Mozilla Firefox) is known as presentation layer. This layer has been built using technologies like HTML, JavaScript, AJAX, JSON, and CSS in this proposed system.

2) Business Layer: Business Access Layer is a middle layer which acts as a mediator Layer between Presentation layer and Data Access layer. This layer is used to transfer the data between Presentation Layer and Data Access Layer. This layer is mainly used for Validations and calculation’s purpose. It is basically an optional layer if we are working on a small project. But if are to work on large projects, then we need to include this layer in 3-Tier Architecture Applications. It is used to enhance the security and prevent the brokering of application. The business logic is the code running on the server that contains processing instructions utilizing technologies such as .NET 4.5. The proposed payroll system uses .NET 4.5 in business layer to implement dynamic pages.

3) Data Access Layer: This Layer only communicates with Business Access Layer. Data Access Layer contains the method that helps Business Access Layer. Business layer class’s methods call the Data Access Layer Class methods to perform some required action with database such as insertion, deletion, updating etc. All database related connection codes are written in this layer only such as SQL query, stored procedure etc. The data tier is containing all the user information, username, and passwords for web application.

- Software Development Life Cycle for payroll system:

Software Development Life Cycle (SDLC) is a framework that describes the activities performed at each stage of a software development project. It starts with the system analysis, design, and implementation and continues through the maintenance and disposal of the system. The steps given below describe implementation of proposed system:

1) System Analysis: Analysis involves a detailed study of the current clipper-based system, leading to specifications of a new computer-based payroll system. During analysis, data are collected on the available files, decision points and transactions handled by the present system. Interviews, on-site observations, and questionnaire are the tools used for system analysis of present system. System Analysis also includes sub-dividing of complex process involving the entire system, identification of data store and manual processes.

2) Existing system: In order to maintain their design, pay slips and other related information to project development, which include customer requirements, storage department is immense. The lack of consistency in pay slips maintenance leads to both loss of work as well as money and time. With the total automation of payroll Management System, the manual storage dependency is minimized to a large extent. Present day organizations, especially large companies house employees in large numbers.

3) Proposed System: The proposed system is a web-based system. The base of the proposed system is a database, which stores all the information pertinent to personnel, allowances, deductions, taxes, savings, and net pay. The payroll system will stay up to date with pay checks and tax filings. This includes calculating allowances, taxes and other deductions, printing individual pay slips and deduction vouchers. The features of the system are-

· It maintains the payrolls as well as employee information.

· The system should also be easy to access, accurate and consistent results can be obtained in the form of documents whenever the user needs.

· It should inherit all the properties of high security, fast recovery, robustness, flexibility, reliability, scalability.